The Foreign Corrupt Practices Act (FCPA) 2022

Many professionals are anticipating an increase in FCPA enforcement actions in 2023, so now is a good time to review your compliance programs and make any necessary improvements.

The DOJ and SEC filed 25 FCPA-related Enforcement Actions in 2022. Though an increase from 2021, last year’s enforcement activity remained well below the ten-year average of 36. The jump in enforcement activity last year led to a concomitant rise in FCPA Matters, which are groups of related enforcement actions that share a common bribery scheme. The nine FCPA Matters initiated in 2022 represent an increase of 50 percent compared to 2021, but that level remains well below the ten-year average of 15.

Only four companies disclosed in their SEC filings a new FCPA-related Investigation commenced by U.S. authorities in 2022. This marks the fourth year in a row that disclosed investigations have tracked well below the ten-year average of 17, a decline that appears to have commenced in 2018.

Read the full report, from the Foreign Corrupt Practices Act Clearinghouse (FCPAC).

*********

For a chronological list of all enforcement actions from 1977 through 2022, please click here (prosecuting agencies: U.S. Department of Justice and the U.S. Securities and Exchange Commission ).

SEC Enforcement Actions: Enforcement of the Foreign Corrupt Practices Act continues to be a high priority area for the SEC. In 2010, the SEC’s Enforcement Division created a specialized unit to further enhance its enforcement of the FCPA, which prohibits companies issuing stock in the U.S. from bribing foreign officials for government contracts and other business. Here is a list of the SEC’s FCPA enforcement actions listed by calendar year.

******************************************************************************************************************************************

The Foreign Corrupt Practices Act: An Overview The Foreign Corrupt Practices Act of 1977, as amended, 15 U.S.C. §§ 78dd-1, et seq. (“FCPA”), was enacted for the purpose of making it unlawful for certain classes of persons and entities to make payments to foreign government officials to assist in obtaining or retaining business. Specifically, the anti-bribery provisions of the FCPA prohibit the willful use of the mails or any means of instrumentality of interstate commerce corruptly in furtherance of any offer, payment, promise to pay, or authorization of the payment of money or anything of value to any person, while knowing that all or a portion of such money or thing of value will be offered, given or promised, directly or indirectly, to a foreign official to influence the foreign official in his or her official capacity, induce the foreign official to do or omit to do an act in violation of his or her lawful duty, or to secure any improper advantage in order to assist in obtaining or retaining business for or with, or directing business to, any person.

Since 1977, the anti-bribery provisions of the FCPA have applied to all U.S. persons and certain foreign issuers of securities. With the enactment of certain amendments in 1998, the anti-bribery provisions of the FCPA now also apply to foreign firms and persons who cause, directly or through agents, an act in furtherance of such a corrupt payment to take place within the territory of the United States.

The FCPA also requires companies whose securities are listed in the United States to meet its accounting provisions. See 15 U.S.C. § 78m. These accounting provisions, which were designed to operate in tandem with the anti-bribery provisions of the FCPA, require corporations covered by the provisions to (a) make and keep books and records that accurately and fairly reflect the transactions of the corporation and (b) devise and maintain an adequate system of internal accounting controls. For particular FCPA compliance questions relating to specific conduct, you should seek the advice of counsel as well as consider using the DoJ’s FCPA Opinion Procedure.

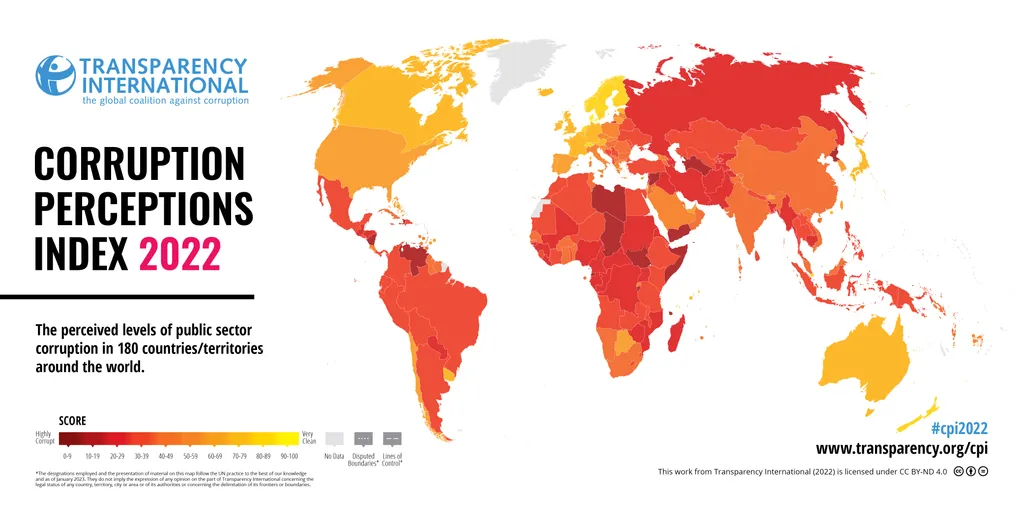

Source: Transparency International’s 2022 Corruption Perceptions Index